Your credit rating (or credit score) gives lenders an idea of how risky you are to lend to.

|

Credit score |

What it means |

|

800 – 850 |

Great. |

|

740 – 799 |

Good. |

|

670 – 739 |

Okay. |

|

580 – 669 |

Bad. |

|

300 – 579 |

OMG. |

If your credit score is high, expect great interest rates on home loans, near-universal approval for credit cards, and an awesome dating life (it’s true: a higher dating score predicts a better dating life).

If it’s low … well, don’t worry. Because we’re going to show you a system to change that.

- What is the credit rating scale?

- Why does it matter?

- How do I check my credit rating?

- How to improve your credit score

- Improve your credit score = Big Win

What’s the credit rating scale?

The credit rating scale is a measure that helps lenders determine whether or not they should lend you something.

Your credit score affects interest rates, credit card approvals, and even things like whether or not you’ll get approved to rent apartments.

While there are different kinds of credit rating scales for individuals, the most commonly used one is the FICO score. FICO stands for Fair Isaac Corporation. They’re a data company that founded the credit scoring system back in the late-eighties.

Their scores are on a range between 300 and 850 and are determined by information found on an individual’s credit report. And there are THREE major credit bureaus that provide these reports:

This means you can have three different credit scores at any time. Granted, the scores won’t typically differ that much from bureau to bureau.

The following pieces of information determine your actual score (courtesy of Wells Fargo):

- Payment history: 35%

- Amounts owed: 30%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Remember: The higher your score, the better it is for you.

Why does it matter?

Here’s a credit score chart with ranges courtesy of Experian — and what they mean for you:

|

Credit score |

What it means |

|

800 – 850 |

Great! This is a fantastic place to be for your credit score. You should have no issue securing a home loan at low interest. |

|

740 – 799 |

Good. Not perfect but certainly not bad either. Your interest rates will still be solid and you’ll still be able to secure things like credit cards, loans, and apartment rentals. |

|

670 – 739 |

Okay. Though not terrible, you should still try to do what you can to improve your score. |

|

580 – 669 |

Bad. This is when you should start worrying since now you’re considered a “subprime borrower.” You might be denied a home mortgage outright and interest rates will be high. |

|

300 – 579 |

OMG. Abandon all hope ye who enter here. You’ll likely be denied for any loans and won’t be able to open up new credit cards. |

So if you’re planning on taking out a loan or attaining credit of ANY kind, you’re going to want to make sure your credit score is in check. If you don’t, you might find yourself saddled with high interest rates and being denied simple loans.

How do I check my credit rating?

To check your credit score, you’ll need to travel thousands of miles through the nine levels of hell, Mordor, Siberia in the winter, AND make it past the topiary maze from “The Shining” before solving a series of riddles from a sphinx who will tell you your credit score in a dead language.

Oh wait, I’m sorry. That’s a typo. I meant checking your credit score is incredibly simple. In fact, there are a TON of sites out there that’ll give you your credit score for free.

Two good ones we suggest: Credit Karma and Mint.

Head to these sites and follow their instructions. Be prepared to enter basic info about yourself (name, DOB, social security #, etc.).

If you find that your credit score is great, congrats! Do all you can to maintain that score (we get to that below).

If your credit score is low though, have no fear. Here’s a system that’ll help you improve your credit score.

How to improve your credit score

Improving your credit score is all about 80/20 — do a small amount of work now and it’ll pay off in spades later.

And you don’t need to do anything crazy either. In fact, here are five keys that’ll help you move the needle on your credit score:

- Delete your debt

- Keep your cards

- Negotiate your limit

- Automate your pay

1. Delete your debt

Debt is one of the BIGGEST barriers preventing people from living a Rich Life. That’s why if you want to be able to start focusing more of your energy on earning more money and investing, you need to delete your debt.

You can do this using Ramit’s five-step system on getting out of debt fast.

Though there are a lot of nuances to this, here’s three quick tips from the system:

- Find out how much you owe. Though it seems obvious, a lot of people hide from their statements each month and don’t actually know how much they owe. This is playing right into the hand of credit card companies who want you to be in debt. Don’t do this. The first step to getting rid of your debt is being real with yourself. Find out exactly how much money you owe.

- Decide what to pay off first. Though some people believe you should pay off your debt with the lowest balance first, Ramit actually suggests you pay off the debt with the highest interest rate first. Doing so will save you more money down the road and can be psychologically beneficial when you see the biggest drain on your money go away.

- Tap into “hidden income.” There are a lot of different ways you can pay off your debt. One of our favorite ways is by tapping into hidden income to free up some money. This is money that you can negotiate from areas like your insurance, phone bill, or even your rent.

For the full system, check out our article on the five steps to get out of debt.

If you want even more insights on getting out of debt, check out Ramit’s old video on negotiating your debt.

2. Keep your cards

A lot of people erroneously believe that they need to get rid of their credit cards to improve their score. After all, credit cards are the reason people get bad credit scores. It would stand to reason that closing the accounts improve it … right?

Wrong. So very, very wrong.

Why? Because 15% of your credit score is determined by your credit history. So if you close accounts, you close that history.

This also negatively impacts your “credit utilization rate” (more on that later).

Of course, there are going to be times when you just need to close a credit card (travel hacking, interest rates too high, etc.). That’s fine so as long as you also make sure you’re not applying to a major loan within six months of closing it.

You want as much credit as possible when you apply for loans.

In general though, keep your cards open and put a recurring charge on them. This shows that your cards are active and keeps your credit history healthy.

3. Negotiate your limit

Your credit utilization rate impacts 30% of your credit score since it impacts the amount you owe.

And the formula for it is simple:

Unlike your credit score, the lower THIS number is, the better.

Let’s look at an example: If you carry $1,000 debt across two credit cards with $2,500 credit limits each, your credit utilization rate is 20% ($1,000 debt / $5,000 total credit available).

If you close one of the cards, suddenly your credit utilization rate jumps to 40% ($1,000 / $2,500). But if you paid off $500 in debt, your utilization rate would be 20% ($500 / $2,500) and your score would not change.

When your credit utilization rate is low, it shows lenders that you don’t typically spend all the money you have available in your credit — which means you likely won’t default and they won’t lose money.

You can improve your credit utilization in two ways:

- Don’t carry a lot of debt on your credit cards.

- Increase the amount of credit available to you.

We’ve already hit the first part — so let’s take a look at a script to help you negotiate your credit limit with your card company:

YOU: Hi, I’d like to request a credit increase. I currently have $5,000 available and I’d like $10,000.

CC REP: Uh … why?

YOU: I’ve been paying my bill in full for the last 18 months and I have some upcoming purchases. I’d like a credit limit of $10,000. Can you approve my request?

CC REP: Okay. I’ve put in a request for an increase. It should be activated in about seven days. Anything else I can do for you?

Ramit suggests requesting a credit limit increase every six to 12 months. Only do this if/when you’re out of debt though.

4. Automate your payments

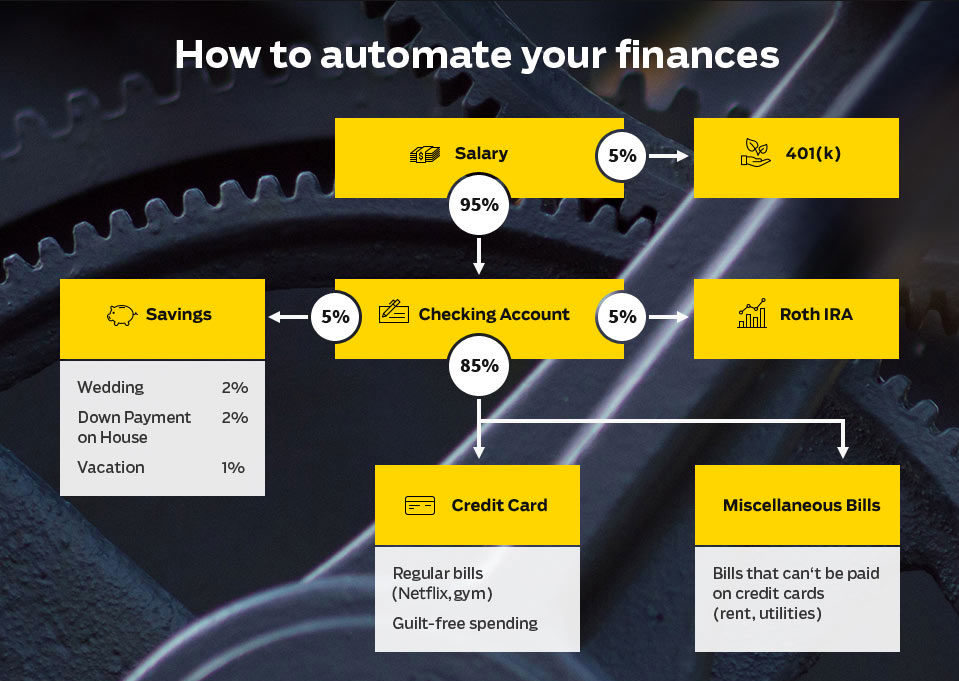

Let’s talk about my FAVORITE subject in the world: Automating your personal finance.

This is IWT’s proven system that does a number of awesome things:

- Gets you out of debt.

- Helps you save for anything.

- Earns you money.

The best part? You do all of this passively. That means there’s no hassle of moving your money around, and no pain from seeing your money part from you.

And since 35% of your credit score is determined by your payment history, it’s important to automate your system so you pay your bill on time and in full each month.

For more information on how to automate your finances, check out Ramit’s 12-minute video where he goes through the exact process with you.

You should ideally be paying off your entire credit card balance each month, but if you can’t, you can still improve your score by paying at least the minimums, on time, every month.

Improve your credit score = Big Win

Take the time to start improving your credit score using the four systems outlined above — and to help you even more, I’d like to offer you something: The first chapter of Ramit’s New York Times best-seller “I Will Teach You to be Rich.”

It’ll help you tap into even more perks, max out your rewards, and beat the credit card companies at their own game.

I want you to have the tools and word-for-word scripts to fight back against the huge credit card companies. To download it free now, enter your name and email below.

Credit rating scale: How to get an amazing credit score is a post from: I Will Teach You To Be Rich.

No comments:

Post a Comment