Though mortgage interest rates might just seem like meaningless numbers flying by in the news marquee, they actually impact how much you’re going to end up paying for a house.

BUT WHAT DOES IT MEAN, NEWS PERSON?

It can potentially affect how much you end up paying for your home by THOUSANDS. The good news is that you can optimize your mortgage — and it starts with knowing how interest rates work.

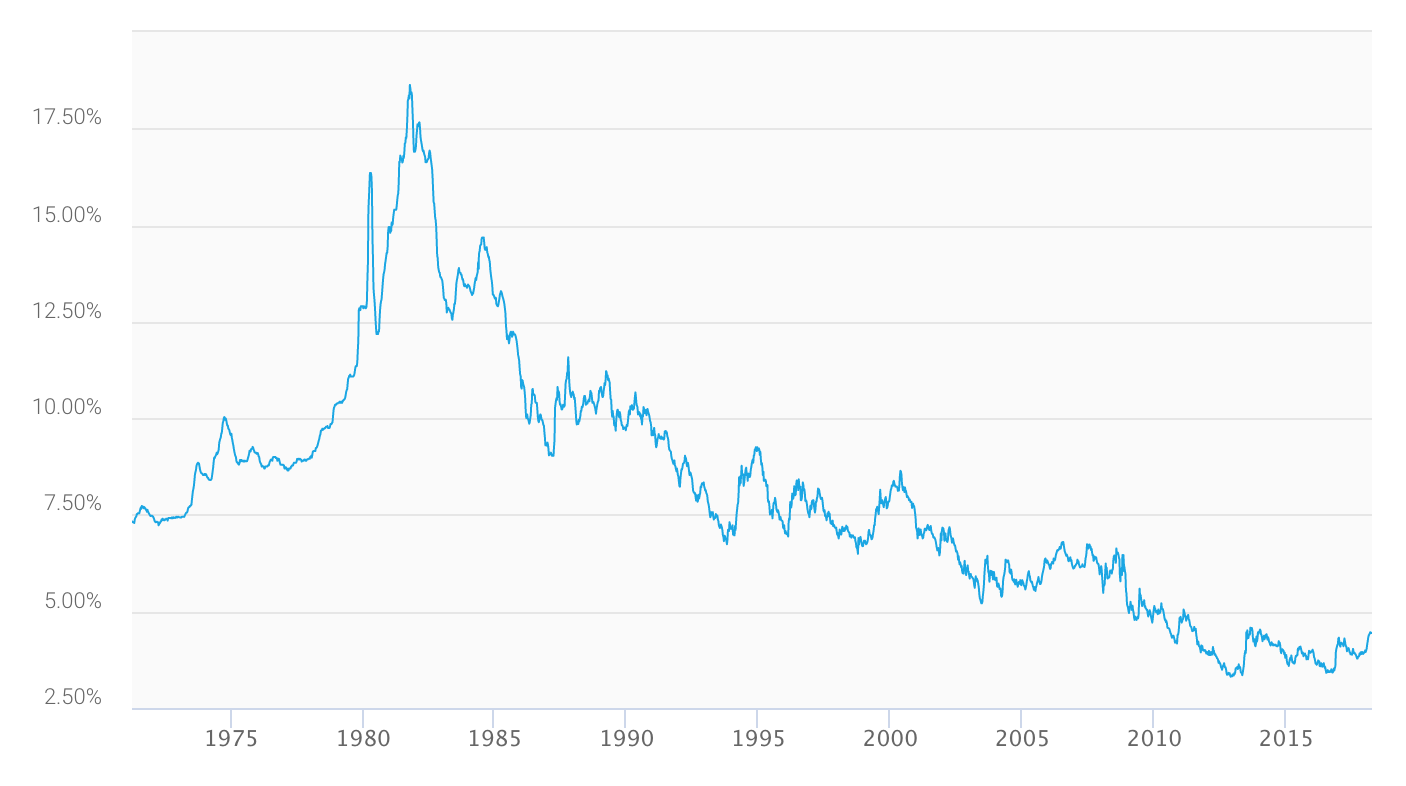

Historic interest rates for 30-year mortgage from Freddie Mac.

The current interest rate for the average 30-year fixed-rate mortgage is about 4% — which is pretty low. BUT I want to show you a system to lower the cost of your mortgage even more AND break down what goes into making the interest rate.

Let’s dig in.

What is the historic interest rate?

The historic interest rate refers to the average mortgage interest rate over time. Knowing what the average interest rate is for the year can help you make sound decisions when it comes to getting a mortgage and buying a house.

Check out the graph of 30-year fixed-rate mortgages below courtesy of Freddie Mac.

X-axis = Year. Y-axis = Interest rate on 30-year fixed-rate mortgage.

A few things to note:

- The HIGHEST historic interest rate was 18.45%. This insanely high interest rate occurred in October 1981 and was caused primarily by the inflation crisis of the late 70s (more on that later).

- Average interest rates have been lower than 6% since 2008. Since the housing crisis, we’ve seen incredibly low interest rates. They’re so low in fact that…

- We’re seeing some of the lowest rates in over three decades. That means potential homeowners are well positioned to buy a house compared to the past.

Knowing these trends gives us valuable indications of what impacts mortgage rates. And knowing how mortgage rates respond to certain elements can help us make better decisions when it comes to home buying.

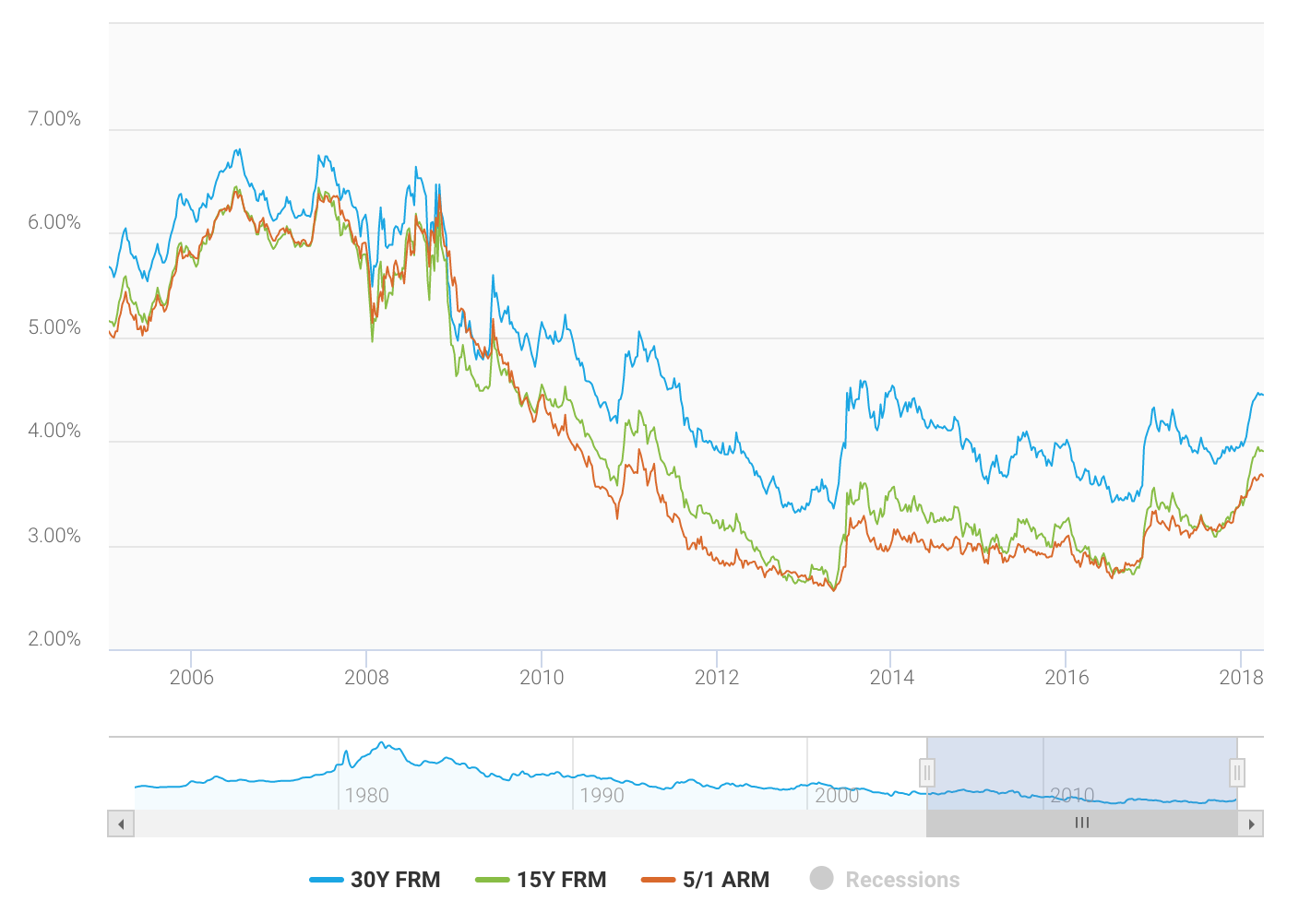

Both 15-year fixed-rate and 5/1 adjustable rate mortgages have tracked the changes with their 30-year counterpart since 2005.

Which makes sense since the mortgage rates are affected by the same conditions.

What affects the interest rate?

Interest rates can seem volatile — but how high or low they are typically depends on three factors: Inflation, the bond market, and supply and demand. Knowing these are the factors can help you understand when the rate fluctuates and why.

Let’s take a look at all three now and see how they impact home interest rates.

Inflation

Inflation is what happens when the price of goods increases over time.

For example, if you have $1,000 sitting in a desk drawer accruing no interest and the inflation rate for the year was 3%, you’d effectively lose $30 by having your money just sitting there. Also, you should totally have a lock for that desk.

However, if you invested it in a low-cost index fund that earned 8% over the year, you’d have effectively earned $50 after you account for inflation.

It’s the same for lenders and their interest rates. If there is higher than average inflation, you can bet the price of a mortgage is going to go up. And that’s exactly what happened in the late 70s / early 80s when the country saw a rise in lending rates increase to nearly 19%. It was a direct result of the 1970s oil crisis raising the price of products across the entire economy and lenders responding to that.

Bond market

When you attain a mortgage, you’re not only paying for your house. You’re also becoming an investment in the form of “mortgage-backed securities” (MBS).

This is an investment asset made up of a collection of mortgages that pay out through the interest you pay each month on the mortgage.

Government bonds and MBSs actually compete with each other because they’re both long-term investments. So how the bond market performs directly impacts how much interest rates will rise or fall.

Kinda like how you try harder on the treadmill when the person next to you is running faster than you.

For example, if the bond market is performing well and yielding a good rate for investors, lenders might lower interest rates to attract investors and remain competitive with bonds.

Supply and demand

Just like you learned in econ, if more people are buying and building homes, lenders are going to charge a higher interest rate to make more money.

Alternatively, if no one is buying or building homes, they’re going to try to attract borrowers by lowering interest rates.

It’s because of supply and demand that the interest rate for mortgages is rarely ever the same from week to week.

How does it affect me?

It’s incredibly scary funny how a home mortgage can be your ticket to your dream home …

… or the albatross weighing you down from a Rich Life.

Luckily, whenever you make a big purchase like buying a house, there’s a HUGE amount of money you can optimize.

Long-time readers know I don’t think buying a house is typically a good investment. That said, if it’s your version of a Rich Life, I want to help you get there. That means optimizing the hell out of your mortgage once you get one.

Here’s how this works: Rather than pay off your mortgage once a month, like most home borrowers do, you’re going to pay it twice a month instead.

No, this doesn’t mean that you’re doubling up on payments. By paying your mortgage bi-weekly, you’re actually taking several years off of your mortgage payments.

Let’s run a scenario using two banks:

- First National Bank of Ramit (FNBR). At FNBR, we have a plan that allows you to make bi-weekly payments with 26 payments a year (52 / 2 = 26).

- U.S. Big Bank. They offer typical monthly mortgages payments at 12 payments a year.

Here’s what a $300,000 30-year fixed-rate mortgage at 6% APR looks like with each bank.

U.S. Big Bank: Each year you’ll make 12 monthly payments of $1,798.65. Over 30 years you’ll end up paying $347,514.57 in interest.

First National Bank of Ramit: With 26 payments of $899.38, you’ll be able to take off a few years from your mortgage AND end up paying just $276,591 in interest. That’s a savings of almost $71,000 in interest payments.

Wow. That’s like 18,000 lattes or one every day for the next 50 years.

Luckily for you, many banks offer bi-weekly plans just like FNBR. The best part? They automate their system so they can painlessly take money from your checking account each week.

Some of these banks might try to nickel-and-dime you with a $4 fee every month — but don’t worry. We have systems to help you negotiate out of those fees.

When it comes to your personal finances, though, worry about the things you can control.

Instead of worrying about the “what ifs” or rising interest rates, make sure your personal finance house is in order so you can maximize what you have.

My team and I worked hard on something to help you do just that:

In it, you’ll learn how to:

- Master your 401k: Take advantage of free money offered to you by your company … and get rich while doing it.

- Manage Roth IRAs: Start saving for retirement in a worthwhile long-term investment account.

- Spend the money you have — guilt-free: By leveraging the systems in this book, you’ll learn exactly how you’ll be able to save money to spend without the guilt.

Enter your info below and get on your way to living a Rich Life today.

How historic interest rates impact your mortgage is a post from: I Will Teach You To Be Rich.

No comments:

Post a Comment